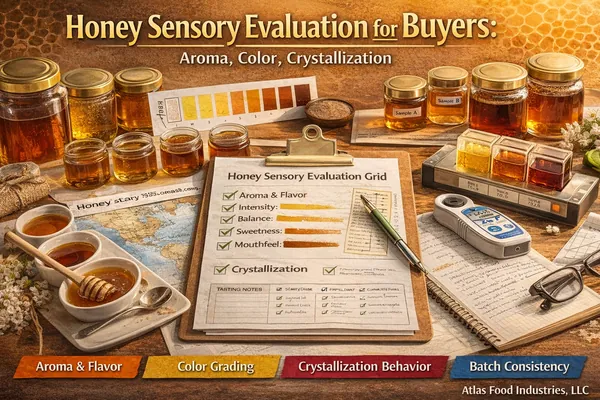

Honey sensory evaluation is the practical method buyers use to translate product characteristics into commercial outcomes: consumer preference, shelf performance, and reorder stability. A strong evaluation process reduces “sample-to-shipment” surprises by aligning your expectations (taste, color, texture) with documented batch realities.

1) Set up a consistent tasting method

Simple controls that improve reliability

- Temperature: taste at the same room temperature each time (avoid cold samples)

- Neutral palate: water and plain crackers between samples

- Tools: clean spoons, small cups; avoid cross-contamination

- Order: mild to strong; light to dark (generally)

- Scoring: use the same note format across suppliers and batches

2) Aroma and flavor: what to look for

Aroma is often the fastest indicator of quality and handling. Buyers typically separate notes into (a) desirable aromatic character and (b) defects or off-notes that may signal fermentation, overheating, or poor storage conditions.

| Dimension | What to evaluate | Buyer relevance |

|---|---|---|

| Aroma intensity | Mild / medium / pronounced; “clean” vs “muddy” profile | Consumer appeal; premium positioning |

| Flavor clarity | Distinct floral/woody/resinous notes vs generic sweetness | Differentiation (monofloral/origin) and repeat purchase |

| Balance | Sweetness vs acidity; bitterness; aftertaste length | Fit for intended use (tea, breakfast, baking) |

3) Color: how buyers interpret it

Color is both a sensory cue and a shelf variable. In retail, consumers often associate lighter honeys with mild taste and darker honeys with stronger character, even when the true driver is botanical origin. For buyers, the practical question is consistency: can you hold a predictable color range across shipments?

4) Crystallization: what it signals and why it matters

Crystallization is a normal behavior in many honeys. Buyers should evaluate it as a functional attribute: speed of crystallization, crystal size, and whether the resulting texture fits your packaging and consumer expectations.

| What to assess | What it looks like | Why buyers care |

|---|---|---|

| Speed | Fast / medium / slow crystallization | Squeeze formats and foodservice prefer stable flow; jar formats may tolerate faster set |

| Texture | Fine/creamy vs coarse/grainy crystals | Consumer experience; “premium” often expects smoother mouthfeel |

| Uniformity | Even crystallization vs separation/layering | Visual acceptance on shelf and in hospitality service |

5) Presentation: viscosity and mouthfeel (the “handling” test)

Buyers should test how honey behaves in real use: drizzle, spread, portion control, and cleanup. This is where sensory connects to operations—especially in foodservice and for high-volume retail SKUs.

5-minute evaluation

- Spoon lift: does it ribbon smoothly or break abruptly?

- Drizzle test: consistent flow vs sudden drops (mess risk)

- Spread test: on bread; does it soak in or sit cleanly?

- Aftertaste: clean finish vs lingering harshness

- Packaging simulation: if possible, test in your intended format (squeeze, portion cup, jar)

6) Turning sensory into acceptance criteria

Sensory evaluation is most useful when it becomes an agreed “acceptance framework” rather than a subjective impression. For procurement, this typically means defining acceptable ranges and documenting them alongside batch-level information.

Aroma notes (2–4 descriptors):

Off-notes: none acceptable / define threshold:

Color: acceptable range (define as a band):

Crystallization expectation: speed + texture + suitability for packaging:

Use case: retail / foodservice / ingredient (primary):

Reference sample: retain as a control for future batches:

Copy/paste: sample request and sensory brief

Channel (retail/foodservice/ingredient):

Honey type (blossom/pine/monofloral) + any origin preference:

Target intensity (mild/medium/strong):

Target color range (acceptable band):

Crystallization expectation (stable flow / fine crystal / acceptable grain level):

Packaging format(s) + size(s):

Initial volume + reorder cadence:

Documentation required (spec sheet, batch info, certificates as applicable):

If you would like a tailored recommendation, share your destination country, packaging preference, and approximate volume. We will respond with a practical next step and suggested product family list.