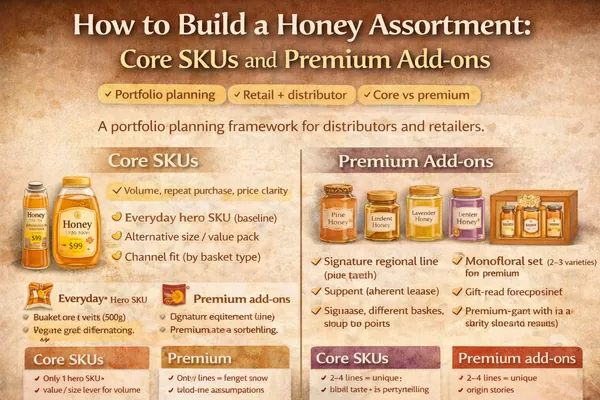

A well-performing honey assortment is designed like a portfolio: a small number of core SKUs drive volume and availability, while a focused set of premium add-ons creates differentiation and trade-up. The goal is not maximum variety—it is clear choice architecture for the shopper and predictable replenishment for the distributor.

1) Define the core SKUs (your volume engine)

Make buying and reordering easy

- One everyday honey profile that is repeatable across shipments

- One value or family format (size or pack architecture) to reduce price friction

- Clear packaging fit for the channel (retail vs foodservice vs ingredient)

| Core decision | Common choices | Why it works |

|---|---|---|

| Everyday hero SKU | Blossom-style / mixed floral style | Broad appeal, repeat purchase, predictable demand |

| Second core lever | Alternative size or value pack | Supports different baskets and price points |

| Channel format | Glass (premium retail) or squeeze (family convenience) | Aligns with shelf expectations and usage behavior |

2) Add premium SKUs for differentiation (without clutter)

Premium SKUs should earn their place by doing one of two jobs: create a clear taste/usage story, or signal origin/rarity that justifies a higher price point. Keep this layer tight—too many premium options dilute velocity.

Pick 2–4 lines that each tell a different story

- Signature line: pine or a regional honey that becomes “your” differentiator

- Monofloral set: 1–2 varieties that are clearly distinct on shelf and in taste

- Gift / premium shelf: a visually premium jar + story-forward positioning

3) Match packaging to channel (and to buying behavior)

| Channel | Best-fit formats | Primary buyer logic |

|---|---|---|

| Retail | Glass jars, premium labels, origin narrative | Trust cues and shelf presence |

| Foodservice / HORECA | Portion cups, squeeze formats | Hygiene, speed, portion control |

| Ingredient supply | Bulk formats aligned with production handling | Operational fit and consistency |

4) Build a simple shelf architecture

Shelf architecture is about reducing decision friction. Use a “Good / Better / Best” structure, or “Everyday / Signature / Rare,” and keep label cues consistent.

5) Launch plan: keep the first buy predictable

Reduce risk and protect velocity

- Start with the smallest SKU set that still communicates “range” (typically 3–6 SKUs)

- Standardize case packs and pallet plans to simplify distributor handling

- Align documentation and label expectations early to prevent delays

- Use sampling or small trial programs for premium lines to create repeat purchase

Questions to include in your assortment brief (copy/paste)

2) Target price positioning (value / mainstream / premium)

3) Packaging formats needed (glass, squeeze, portion cups, bulk)

4) Initial SKU count target (e.g., 4 SKUs) and preferred sizes

5) Expected monthly/quarterly volume range

6) Label language + compliance requirements (any certificates/programs)

Practical next step

If you share your destination country, channel, packaging preference, and approximate volume, we can suggest a compact assortment (core + premium add-ons) and a packaging plan aligned to your market.