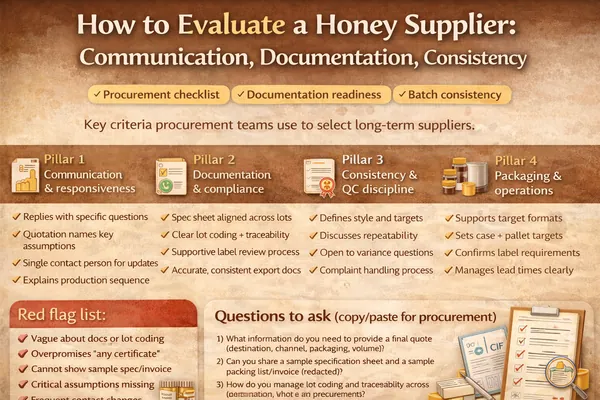

Honey is not only a taste decision—it is a repeatability and documentation decision. Procurement teams typically evaluate suppliers on three core pillars: how they communicate, how they document and control batches, and how consistent deliveries remain over time.

1) Communication that reduces uncertainty

Fast, structured answers and a clear quotation process

- Replies with specific questions (destination, channel, packaging, volume) instead of generic sales text

- Provides a clean quotation with assumptions stated (Incoterm, lead time, case pack, pallet plan)

- Names a single accountable contact for updates and issue resolution

- Explains timelines in a sequence (confirmation → production/filling → documents → shipment)

2) Documentation readiness and traceability

Most shipment delays happen because documentation is not aligned with destination requirements or buyer internal compliance rules. Evaluate whether the supplier can work with a buyer’s documentation checklist without friction.

| Document / artifact | Why it matters | What to verify |

|---|---|---|

| Specification sheet | Aligns product expectations across lots | Version control, clear limits, signed/dated |

| Batch / lot coding | Enables traceability and complaint handling | Lot format, where printed, how recorded |

| Label review support | Prevents border and shelf issues | Language, net weight, importer details, claims discipline |

| Export paperwork | Controls customs flow | Invoice + packing list accuracy, B/L or AWB readiness |

3) Consistency across shipments (the real test)

How the supplier controls repeatability

- Clear product definition (style, intended use, target profile)

- Ability to repeat the same profile across multiple shipments

- Willingness to discuss variance and how it is managed (without overpromising)

- Structured approach to handling complaints and corrective actions

4) Packaging capability and operational discipline

Even strong honey can fail in market if packaging, labeling, or case packing is inconsistent. Confirm operational capability early—especially for private label or foodservice formats.

- Can the supplier support your formats (jars, squeeze, portion cups, bulk)?

- Do they confirm case pack, palletization, and loading plan up front?

- Do they have an approval process for labels and artwork?

- Do they communicate lead times and cut-off dates clearly?

Red flags to treat seriously

- Vague answers on documentation or unwillingness to share sample docs

- Overpromising on “any certificate” without clarifying destination specifics

- No clear batch/lot system or inconsistent explanations of traceability

- Quotation lacks assumptions (Incoterm, lead time, packaging details)

- Frequent changes in contact person or slow follow-up

Questions to ask (copy/paste for procurement)

2) Can you share a sample specification sheet and a sample packing list/invoice (redacted)?

3) How do you manage lot coding and traceability across shipments?

4) What packaging formats do you support, and what are typical case packs/pallet plans?

5) What is your standard lead time from confirmation to shipment, and what milestones do you track?

6) How do you handle complaints and corrective actions?

Practical next step

If you want us to propose a first-order assortment and a documentation-forward shipment plan, send your destination country, channel (retail/foodservice/ingredient), packaging preference, and quantity range. We will respond with a practical next step and suggested product family list.