Royal jelly is one of the most temperature-sensitive bee products in commercial trade. For buyers, the key success factor is not only sourcing a compliant product, but building a logistics plan that protects quality from the moment of packing through customs clearance and final receiving. This guide explains what to lock in early, what to monitor during transit, and how to structure a cold-chain shipment so your first order is routine rather than stressful.

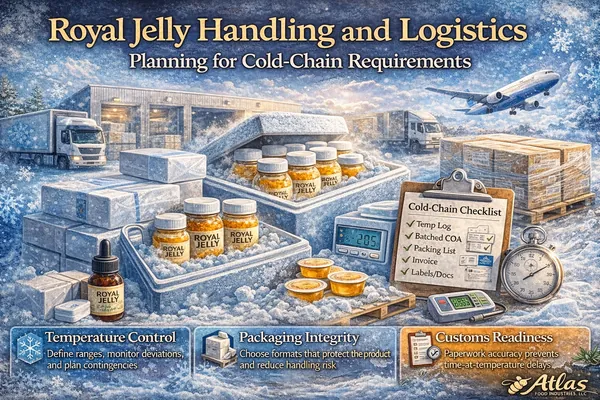

Define ranges, monitor deviations, and plan contingencies.

Choose formats that protect the product and reduce handling risk.

Paperwork accuracy prevents time-at-temperature delays.

Contents

1) Why cold-chain matters for royal jelly 2) Chilled vs frozen: selecting the right shipping mode 3) Packaging formats that support cold-chain performance 4) Transport options and how buyers choose routes 5) Temperature monitoring and acceptance criteria 6) Documentation buyers commonly request 7) Receiving SOP: what to check on arrival 8) Cold-chain risk controls and contingency planning 9) Buyer checklist for RFQ and first shipment 10) FAQ1) Why cold-chain matters for royal jelly

Royal jelly is a high-moisture, bioactive product. Buyers typically treat it as a cold-chain item because temperature excursions can accelerate quality loss, create variability between lots, and shorten practical shelf life after arrival. Cold-chain planning is therefore part of your quality specification—not an optional logistics detail.

- Quality stability: better retention of sensory profile and consistency across batches.

- Operational predictability: fewer disputes at receiving and smoother replenishment planning.

- Regulatory and customer expectations: many buyers require defined storage conditions and traceability.

2) Chilled vs frozen: selecting the right shipping mode

Buyers generally select a shipping mode based on transit time, customs uncertainty, and downstream storage capacity. There is no single “correct” answer; the correct answer is the mode that matches your route reality.

| Mode | Best use-case | Buyer advantages | Typical risks |

|---|---|---|---|

| Chilled | Short routes, fast clearance, immediate receiving | Lower freight cost vs frozen; easier handling in some warehouses | Higher sensitivity to delays; more exposure to deviations during clearance |

| Frozen | Long routes, multi-stop distribution, uncertain clearance time | More robust buffer against delays; stronger quality protection | May require frozen storage capacity and specific receiving SOP |

How to decide quickly

- If customs clearance can realistically add days, frozen shipments often reduce risk.

- If you cannot store frozen locally, chilled may be required—but plan the route tightly.

- If you distribute to multiple locations, frozen often improves downstream consistency.

3) Packaging formats that support cold-chain performance

Royal jelly packaging is not only a marketing choice; it is a cold-chain control mechanism. Buyers typically consider three packaging layers: primary container, secondary protection, and outer case/shipping unit.

Primary containers

- Small jars (retail-ready): simple for end-users, but higher unit handling and more exposure during repacking.

- Foodservice / brand repack containers: balanced handling, efficient for controlled portioning.

- Bulk formats: lowest unit cost, best for manufacturing, requires strong receiving controls.

Secondary protection

- Insulation and separators reduce temperature fluctuation and physical shock.

- Sealed liners and moisture control improve case hygiene and reduce odor transfer risk.

Outer cases and palletization

- Case labeling should support rapid receiving: SKU, lot, production date, storage condition, and net weight.

- Pallet configuration should match cold-store racking and minimize time on dock.

4) Transport options and how buyers choose routes

Buyers typically choose logistics based on a trade-off between transit time, temperature control, and cost. Your supplier can support different methods, but you should decide your operational tolerance first.

- Air freight: fastest; often used for smaller volumes or urgent replenishment.

- Temperature-controlled road: viable for regional trade when route time is predictable.

- Temperature-controlled ocean: suited for larger volumes; requires strong planning and monitoring discipline.

Route planning questions buyers should ask

- What is the realistic door-to-door timeline, including customs?

- Who is responsible for temperature control at each handoff?

- Where are the highest-risk dwell points (airport handling, port storage, broker delays)?

- Is temperature monitoring available end-to-end, and who receives the data?

5) Temperature monitoring and acceptance criteria

Temperature monitoring prevents disputes by turning “it felt warm” into objective evidence. Buyers commonly request monitoring for cold-chain shipments, especially for first orders.

What to monitor

- Temperature exposure: start-to-finish readings with timestamps.

- Transit duration: confirms whether dwell points exceeded plan.

- Seal integrity: evidence that packaging was not compromised in transit.

Acceptance criteria (practical)

- Define acceptable temperature range and allowable excursion time in the PO or spec annex.

- Define how disputes will be handled if excursions occur (hold, lab test, partial acceptance, etc.).

- Align criteria with your internal QA policy and your downstream customer requirements.

6) Documentation buyers commonly request

Documentation expectations vary by destination country, buyer category, and whether the product is sold as retail, used in foodservice, or supplied to manufacturers. However, buyers typically want a consistent set of batch-linked information.

- Specification sheet: identity, form (fresh/frozen), storage conditions, shelf-life statement.

- Batch/lot identification: production date, lot code structure, and traceability references.

- Certificate of Analysis (CoA): batch-linked analytical results as agreed with the buyer.

- Export documents: commercial invoice, packing list, and other destination-required items.

- Additional certificates: depending on market and buyer compliance programs.

7) Receiving SOP: what to check on arrival

The receiving process is where many cold-chain programs succeed or fail. A short, standardized SOP reduces variability across warehouses and prevents unnecessary disputes.

Dock-to-freezer time control

- Pre-book receiving slot and ensure cold storage space is available.

- Prioritize unloading and movement into storage before counting every unit.

- Count and reconcile after product is protected (where feasible).

Inbound checks

- External condition: pallet stability, case damage, wet cartons, seal integrity.

- Labeling: SKU, lot, net weight, storage condition, and language requirements.

- Temperature evidence: logger status, printouts, or digital records.

- Batch traceability: match lot codes to documents and PO.

8) Cold-chain risk controls and contingency planning

Risk controls are not complicated, but they must be intentional. Buyers who build a simple contingency plan reduce the chance that a minor delay becomes a product dispute.

- Route buffers: avoid routes with repeated handoffs and unpredictable dwell points.

- Documentation readiness: pre-validate documents with your broker when possible.

- Clear ownership: define responsibility for temperature control across handoffs.

- Contingency storage: identify local cold storage options near port/airport if needed.

- Escalation protocol: who decides holds, testing, or acceptance if monitoring flags issues.

9) Buyer checklist for RFQ and first shipment

Before RFQ

- Destination country and intended channel (retail, foodservice, ingredient)

- Preferred form (chilled vs frozen) and available storage capability

- Preferred packaging format and labeling needs

- Target volume and delivery cadence

In the purchase order

- Storage conditions and agreed shipping mode

- Temperature monitoring requirement and who receives the data

- Acceptance criteria and deviation handling procedure

- Batch traceability and document list tied to shipment

Before dispatch

- Confirm receiving appointment and cold storage availability

- Confirm broker has all paperwork to minimize clearance time

- Confirm packaging configuration and case/pallet labels

10) FAQ

Should royal jelly be shipped chilled or frozen?

Many buyers prefer frozen shipments for longer transit or multi-stop distribution. Chilled shipments can work for shorter routes if temperature control is consistent and receiving is immediate. The right approach depends on transit duration, customs clearance time, and your downstream storage capability.

What documents do buyers typically request for royal jelly?

Buyers commonly request a specification sheet, batch/lot identification, certificate of analysis, and export documentation. Additional certificates can be required depending on destination and buyer category.

How can buyers reduce cold-chain risk during customs clearance?

Align paperwork early, choose predictable routes, use appropriate insulated packaging and temperature monitoring, and confirm receiving/storage readiness before dispatch. The objective is to reduce dwell time and prevent unmanaged handoffs.

What should buyers check immediately at receiving?

Confirm pallet/case condition, verify labeling and lot codes against documents, and secure the product into cold storage quickly. Review temperature monitoring evidence and quarantine if deviations are flagged while you evaluate next steps.