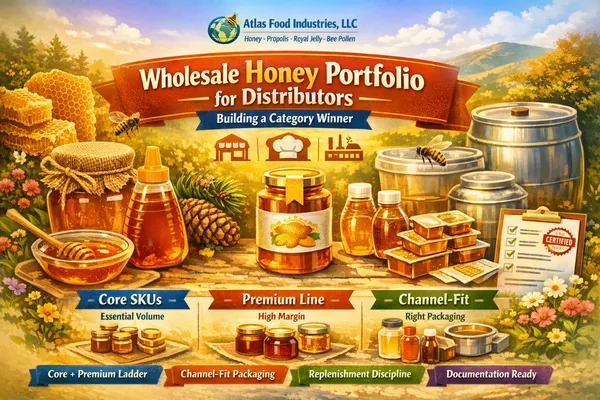

Distributors serving mixed customer types (retailers, foodservice operators, and ingredient buyers) rarely succeed with a “one honey fits all” approach. Category winners build a portfolio ladder: a core tier that moves volume, a premium tier that improves margin and differentiation, and channel-fit formats that solve practical usage needs.

1) Portfolio architecture that serves mixed customers

A distributor’s job is to cover multiple buying occasions without bloating inventory. The simplest way to do that is to separate your portfolio into three roles, each with a clear purpose and set of pack formats.

2) How many SKUs is “enough”?

Starting lean improves turns and reduces forecasting errors. For most distributors, 4–8 SKUs is sufficient to cover the core and premium tiers plus the formats that matter in your market.

| Customer type | Minimum coverage | What to avoid |

|---|---|---|

| Retail | Core jar + premium jar + squeeze | Too many pack sizes at launch |

| Foodservice | Portion packs + 1–2 multi-use packs | Retail-only formats with poor back-of-house fit |

| Ingredient / repack | Bulk format aligned to production handling | Underestimating lead times and batch planning |

3) Packaging strategy: win by channel, not by compromise

Packaging performs when it aligns with usage. Premium shelves typically favor glass and origin cues. Foodservice prioritizes hygiene and cost-per-serving. Manufacturers prioritize handling efficiency. Treat packaging as a channel tool, not decoration.

| Format | Best fit | Operational advantage |

|---|---|---|

| Glass jar | Retail (core + premium) | Strong shelf cues and premium perception |

| Squeeze bottle | Retail, convenience-led households | Repeat purchase through daily-use convenience |

| Portion packs | Hotels, catering, cafés | Hygiene, portion control, predictable cost-per-serving |

| Bulk formats | Ingredient, central kitchens, repack | Lower packaging cost and efficient handling |

4) Price ladder and positioning that sells

Distributors increase category profitability when they maintain a clear ladder instead of discounting everything into a single tier. A practical ladder is: core for turns, premium for margin, and formats for retention.

5) Replenishment discipline: what separates winners

The portfolio only works if replenishment is predictable. Distributors typically perform best when they run a simple cadence: core SKUs stocked continuously, premium replenished in planned cycles, and formats replenished based on channel contracts or seasonal demand.

Simple replenishment rules

- Core: prioritize availability; avoid stockouts

- Premium: planned cycles; avoid overstocking slow movers

- Formats: align with channel (foodservice contracts / seasonal peaks)

6) Documentation and labeling: reduce friction early

For distributors, the “hidden cost” is admin friction—approvals, customer audits, destination requirements, and label expectations. Fast programs treat documentation as a workstream from day one.

7) What to send for a fast, accurate quotation

Customer mix (retail / foodservice / ingredient) + top channels:

Preferred formats (jar / squeeze / portion / bulk) + pack sizes:

Core SKU target (profile + positioning):

Premium SKU target (e.g., pine/origin-forward) + positioning:

Volume forecast (trial + 3–6 month outlook) by tier/format:

Label language(s) + importer/distributor details:

Documentation/certificates required (if any):

Target shipment window:

If you would like a tailored portfolio recommendation, send your destination country, customer mix, packaging preference, and approximate volume. We will respond with a practical next step and a suggested product family list designed for distributor turns and margin.