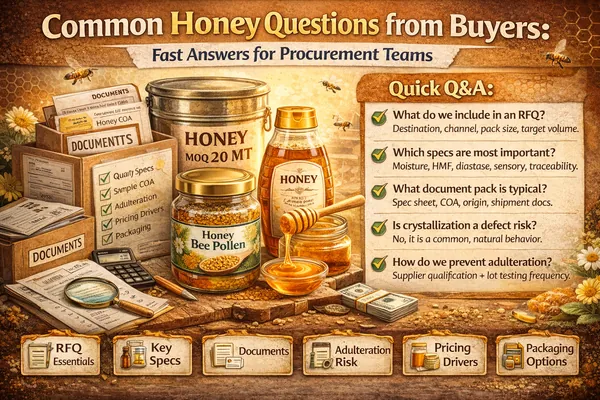

Honey procurement typically sits at the intersection of brand, quality, regulatory compliance, logistics, and commercial targets. The fastest way to reduce internal back-and-forth is to standardize your questions—and request the same supporting documents and specifications each time.

Below are procurement-ready answers to the questions buyers ask most often. Use them as internal guidance, supplier evaluation criteria, and a template for faster RFQs.

1) What should we include in an RFQ for honey?

Procurement outcomes improve when the RFQ includes channel, destination, and packaging details. A “honey” request without context usually triggers multiple follow-ups and a slower quotation cycle.

| RFQ Field | Why it matters | Example |

|---|---|---|

| Destination country | Determines documentation and labeling expectations | Germany / UAE / USA |

| Channel | Drives pack format, label, and specs | Retail / Foodservice / Industrial |

| Honey type | Changes color, taste, crystallization, price | Blossom / Pine / Monofloral |

| Format | Affects freight, handling, and shelf | Glass jar / PET jar / Drum |

| Size + quantity | Required for cost model and line planning | 400g x 1 pallet / 20 MT bulk |

| Label approach | Impacts lead time and approvals | Private label / Branded |

| Target tier | Aligns profile to price architecture | Value / Mid / Premium |

2) Which quality parameters are most important?

Specifications vary by destination and channel, but most professional buyers align on a core set of measurable parameters plus sensory expectations. The intent is to protect brand quality and reduce risk of non-conforming shipments.

Fast answer

Start with moisture, HMF, diastase activity, sensory profile, and traceability. Then add destination-specific requirements and residue monitoring expectations.

- Moisture: influences stability and fermentation risk; often a primary gate.

- HMF: indicator associated with heat exposure and aging; used as a quality control parameter.

- Diastase activity: commonly used to assess heat impact and handling.

- Electrical conductivity: useful in some origin/type differentiation contexts (e.g., honeydew vs blossom patterns).

- Sensory: color, aroma, taste notes, aftertaste, and texture expectations.

- Residue monitoring: buyer-defined expectations around pesticides/antibiotics depending on market rules and risk policy.

3) What documents should we request from suppliers?

Documentation expectations depend on the destination country and your customer’s onboarding requirements. However, procurement teams typically standardize a baseline pack for supplier screening and then expand it for shipment release.

| Document | When used | Procurement purpose |

|---|---|---|

| Product specification sheet | Supplier screening + onboarding | Confirms target parameters, packaging, and identity |

| COA (Certificate of Analysis) | Per lot / per shipment | Verifies measured parameters for the batch |

| Traceability / batch information | Onboarding + audits | Supports recalls, root-cause investigation |

| Commercial docs | Shipment execution | Invoice, packing list, transport docs |

| Certificate of origin | Many destinations | Origin declaration for import and labeling alignment |

| Market-specific certificates (as required) | Destination dependent | Meets local regulatory/customer requirements |

4) How do we manage adulteration risk in procurement?

Procurement teams typically manage risk through a combination of supplier qualification, documentation discipline, and lot-based verification. The right approach depends on your market and your internal risk policy, but the process usually includes:

- Supplier screening: verify capacity, traceability, and consistency across shipments.

- Specification alignment: set measurable acceptance criteria and COA requirements.

- Lot controls: require batch IDs and maintain retention samples when relevant.

- Independent testing strategy: align third-party testing frequency to risk level, channel, and volume.

5) How do we choose between blossom, pine, and monofloral?

Fast answer

Choose based on your shelf tier and taste target: blossom for broad appeal, pine/honeydew for darker and more intense notes, and monofloral for premium differentiation.

- Blossom honey: usually the “core SKU” for mass volume and wide acceptance.

- Pine honey (honeydew style): distinct profile that can support premium or specialty positioning in some markets.

- Monofloral: highest storytelling value; requires tighter consistency management and clearer identity expectations.

6) Is crystallization a quality problem?

Fast answer

No. Crystallization is a natural texture change in many real honeys and does not indicate spoilage or adulteration. Storage temperature strongly affects how quickly it occurs.

For procurement, crystallization becomes a “problem” only when retail teams or end customers are not educated. Many brands include a small label line such as “Natural crystallization may occur.”

7) What is typical shelf life and how should honey be stored?

Honey is naturally shelf-stable when properly handled and sealed. Procurement teams typically confirm:

- Declared shelf life: align to your market and retailer requirements.

- Storage recommendation: dry ambient storage; avoid high heat and avoid refrigeration for consumer packs when crystallization complaints are a concern.

- Packaging integrity: cap seal performance and moisture ingress controls.

8) Which packaging formats are common in procurement?

Packaging choice is a commercial lever. It affects freight, breakage, shelf positioning, and consumer habit.

- Glass jars: premium shelf signal; higher shipping weight and breakage sensitivity.

- PET jars: lower freight, lower breakage; strong value-tier fit; premium possible with good design.

- Squeeze bottles: convenience, high repeat use, family positioning.

- Bulk: drums/pails for industrial and repack operations; focus on handling and traceability.

9) What lead times should procurement expect?

Lead times depend on stock availability, packaging selection, label approval, and shipment mode. For planning purposes, buyers typically separate:

- Sampling + approval cycle: includes label review and internal sign-off.

- Production/packing cycle: depends on pack format and line scheduling.

- Transit time: depends on destination and mode (sea/road/air).

10) What changes when sourcing private label?

Private label adds steps: artwork, regulatory review, barcode setup, carton design, and retailer onboarding requirements. The best practice is to lock packaging components early (jar, cap, label material) to avoid late-stage delays.

11) What drives pricing differences between honeys?

Procurement teams typically see pricing move based on:

- Honey type and supply availability (blossom vs pine vs monofloral)

- Quality/specification targets and testing requirements

- Packaging choice (glass vs PET vs squeeze) and secondary packaging strength

- Volume and delivery terms (incoterms), plus freight seasonality

12) Supplier evaluation: what to check before the first PO

| Area | What to verify | Why it matters |

|---|---|---|

| Traceability | Batch IDs, lot records, retention approach | Recall readiness and consistency |

| Quality system | COA discipline, sampling plan, corrective actions | Reduces nonconformance risk |

| Packaging execution | Cap torque, leak testing, carton strength | Reduces claims and returns |

| Communication | Responsiveness, clarity, documentation speed | Faster cycle times and fewer surprises |